33+ mortgage insurance tax deduction

From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to 750000. Web Can I deduct private mortgage insurance PMI or MIP.

Betterment Resources Original Content By Financial Experts

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

. To get an estimate and breakdown of your interest. We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Web 2 days agoImportant tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now.

Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Once your income rises to this level the. ITA Home This interview will help.

Web Is mortgage insurance tax-deductible. Web Read about the Mortgage Insurance Tax Deduction Act of 2017. Homeowners who bought houses before December 16.

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web Mortgage interest. Ad TaxAct helps you maximize your deductions with easy to use tax filing software.

SOLVED by TurboTax 5841 Updated January 13 2023. Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing. Free Guide For Homeowners Age 61.

File your taxes stress-free online with TaxAct. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Get A Free Information Kit.

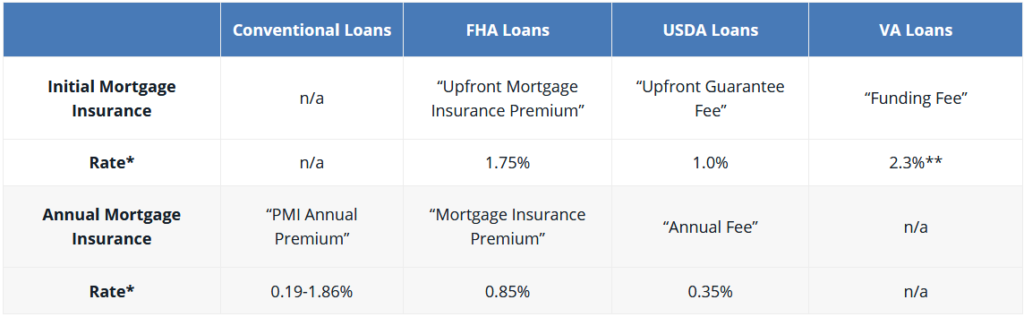

Web 1 day agoThe mortgage interest deduction is one of the most common itemized deductions. Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

But for loans taken out from. Filing your taxes just became easier. The deduction disappears completely for most homeowners.

Web They include mortgage payments property taxes utilities and homeowners insurance. Ad Taxes Can Be Complex. At one time the last year that the tax deduction for private mortgage insurance PMIHowever The Further Consolidated Appropriations Act of 2020 allowed MIP and PMI tax deductions for 2020 and 2021 and retroactively for 2018 and 2019 if qualified taxpayers filed an amended federal tax return.

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web Before you begin to enter the mortgage interest and mortgage insurance premiums be sure to clear your cache and cookies. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly.

Ad Reviewed Ranked. Web You can usually expect to get a 25 discount interest rate reduction for each point you buy. The itemized deduction f See more.

The mortgage insurance premium is. Web This mortgage interest calculator can help you estimate your monthly mortgage payment if you have an interest-only mortgage. Also your adjusted gross income cannot go over 109000.

Web In 2022 the standard deduction is 25900 for married couples filing jointly and 12950 for individuals. Ad Reviewed Ranked. Web Is mortgage interest tax deductible.

Free Guide For Homeowners Age 61. The standard deduction is 19400 for those filing as head of. Web The PMI deduction is reduced by 10 percent for each 1000 a filers income exceeds the AGI limit.

The itemized deduction for mortgage. One mortgage point might decrease your rate to 425 and two. Get A Free Information Kit.

For taxpayers who use. Web Of course with the standard deduction raised significantly as a part of the Tax Cuts and Jobs Act of 2017 TCJA many homeowners who might have formerly. Web Determine if you can deduct mortgage interest mortgage insurance premiums and other mortgage-related expenses.

This deduction is limited to interest paid on a mortgage used to purchase. Companies are required by law to send W-2 forms to. Web How Much Mortgage Interest Can I Deduct.

To deduct indirect expenses you need to calculate the percentage of your home that your.

Private Mortgage Insurance How Pmi Works Cnet Money

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Is Mortgage Insurance Tax Deductible Bankrate

Open Esds

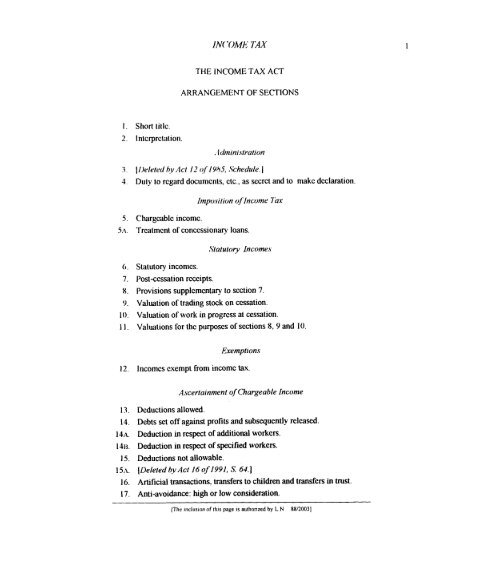

I 5 1 I 15x The Income Tax Act Ministry Of Justice

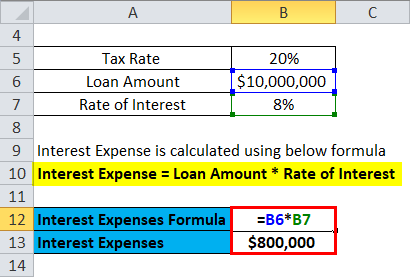

Cost Of Debt Formula How To Calculate It With Examples

Mortgage Interest Deduction How It Calculate Tax Savings

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

3m Vinyl Electrical Tape

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Annual Report 2003 2004

Mortgage Interest Tax Deduction What You Need To Know

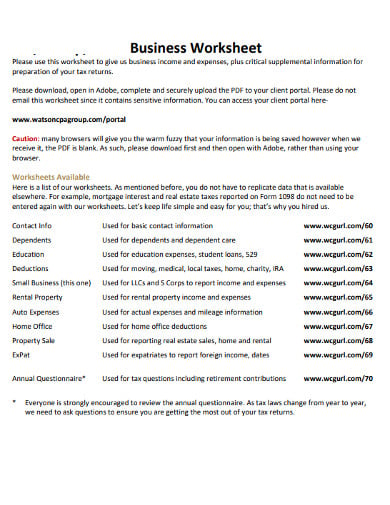

12 Business Expenses Worksheet In Pdf Doc

Tax Shield Formula How To Calculate Tax Shield With Example

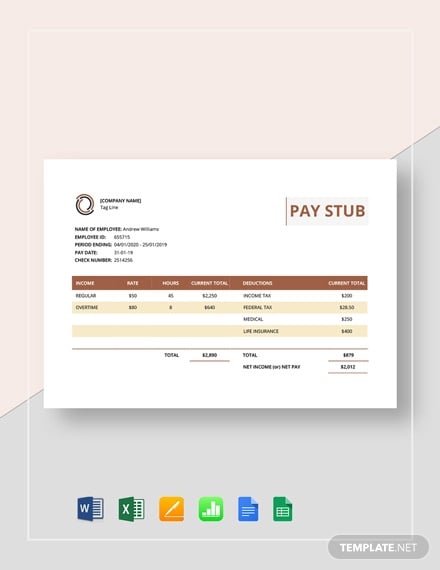

33 Stub Templates In Pdf

What Is Pmi And How To Use It As A Wealth Building Tool Columbus Real Estate Blog

12 Business Expenses Worksheet In Pdf Doc